DCA Bots On Mizar

Dollar-cost averaging [DCA] is among the most effective practices newbies and experts can adopt to boost their trading performance overall. This write-up explains why Mizar DCA bots might be the best pick. You’ll also learn how you can start using automated bots in just under a few clicks.

Introduction to Mizar DCA Bots

A DCA trading robot is not a two-legged android made of metal and plastic but a computer program that works together with the Mizar interface. DCA bots connect to your crypto exchange account via API — a client-server program interface in which the server has all the commands. DCA bots use these commands to manage orders, adjust positions, and more.

Let’s analyze why you might want to use Mizar DCA bots on top of your manual crypto spot trading/crypto futures trading or maybe even instead

Why Use Mizar DCA Bots?

Here are three reasons why you should consider Mizar DCA bots.

1. Simplified trading experience

2. Complete & emotionless experience

3. Smart order management for market orders

Simplified Trading Experience

Most newbies (but even seasoned traders!) struggle to invest because it’s a complex process. Well, is it? Mizar DCA bots allow you to automate daily, weekly or monthly purchases if you have enough balance on your exchange account. Imagine you could forget about boring charts and technical analysis whatsoever.

You can copy trade immediately by following copy-trading DCA bots, or create your own bots to manually set orders like Take Profit, Stop Loss, and more advanced ones. Either way, your DCA onboarding will be pretty intuitive with Mizar.

Complete & Emotionless Trading Experience

Understanding trading intricacies and technical analyses doesn’t guarantee efficient traders. Sometimes traders trap themselves in impulsive and ill-considered decisions. When the price plummets, some traders panic and get rid of cheap assets, while others prefer to buy them at a low price, believing that their purchase will be justified in the future. Such spontaneous actions may ruin profits or cause significant losses.

Candlestick charts, trading indicators, news agenda, emotions, and much more… It’s not easy to control the ups & downs of the market while also dealing with emotions simultaneously. Mizar DCA bots cross out emotions off the trading equation. As a result, you can enjoy emotional comfort and steady profits [if the bot is built well].

Smart Order Management

On Mizar, you can set custom DCA bot parameters, crypto limit orders and place orders at multiple entry points [low levels], thus reducing the total entry price if the market continues to trend downward. This way, you follow an effective long-term strategy to either accumulate the asset or take profits along the way.

Here’s the most crucial parameters described briefly.

Take Profit [TP]

Take Profit is an order to secure profits once your trade reaches a benchmark set. More specifically, it's an automatically executed reverse trade. If you set Take Profit for a buy position, your asset will be automatically sold once the % set is reached. If you open a short position, your asset will be bought. Either way, you close a position completely to avoid the potential consequences of further price change.

Stop Loss [SL]

Stop Loss is another order traders use to manage their positions. Simply put, crypto stop loss limits potential losses when the asset price goes against your open position. SL is an immediate stop order, i.e., it closes the trade immediately as soon as the price reaches the level specified. This way, you can limit losses partly or entirely depending on your risk tolerance.

Trailing Take Profit [TTP]

TTP is an advanced version of TP. Instead of remaining at a specific price level, TTP trails or follows behind the price when it moves in a direction more profitable for you. TTP helps you to secure potential profits, as it follows the desired market trajectory while capping the possible downside.

Starting from scratch? Spot a deep dive into DCA Bot settings to find out more.

Getting Started with Mizar DCA Bots

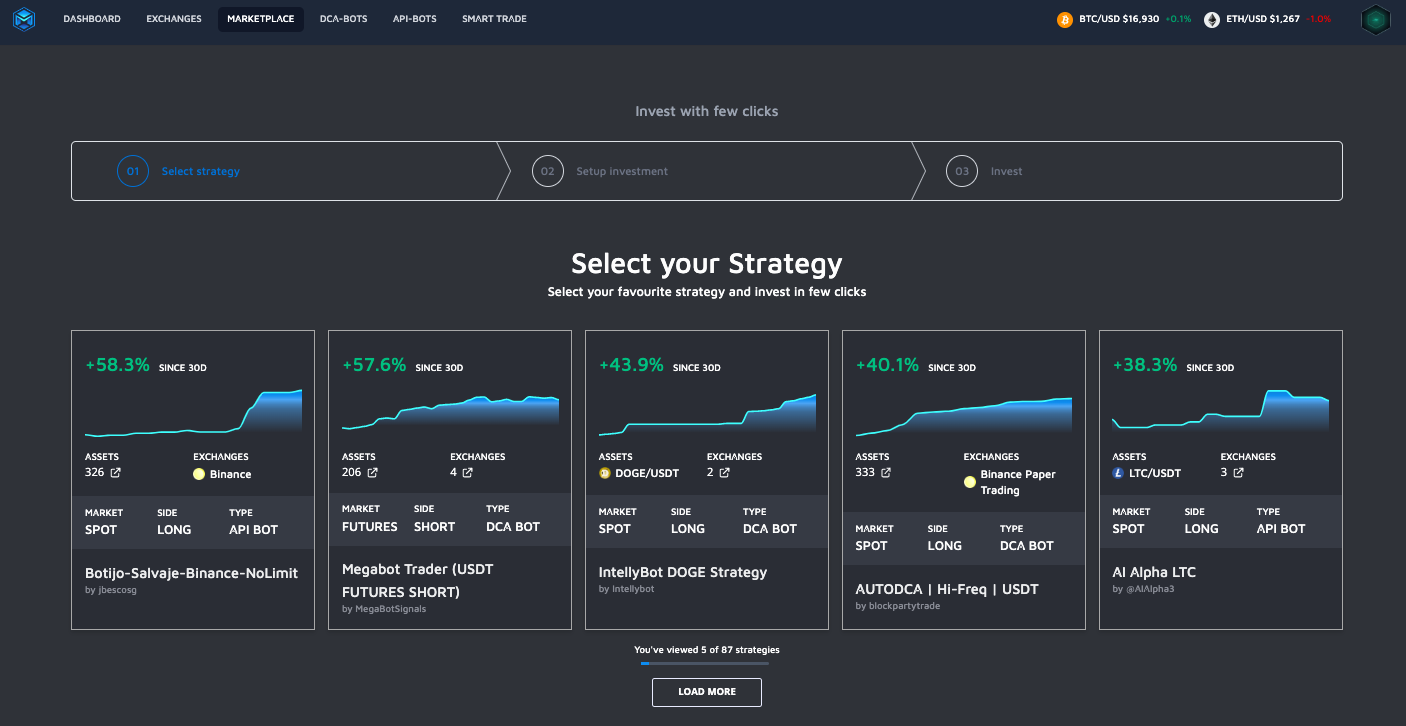

In this section, we touch on marketplace DCA bots you can launch in a few clicks. The feature is commonly known as Copy Trading, and it’s a go-to solution for most newbies and for traders who want to diversify their investments.

Are you a seasoned trader, or learning how to trade with bots? Customize your DCA experience by setting trading parameters onfrom Mizar’sa user-friendly interface. No coding required! Here’s how you can set your custom DCA bot up and running.

Launching Your Mizar DCA Bot

1. Head over to the Mizar trading platform

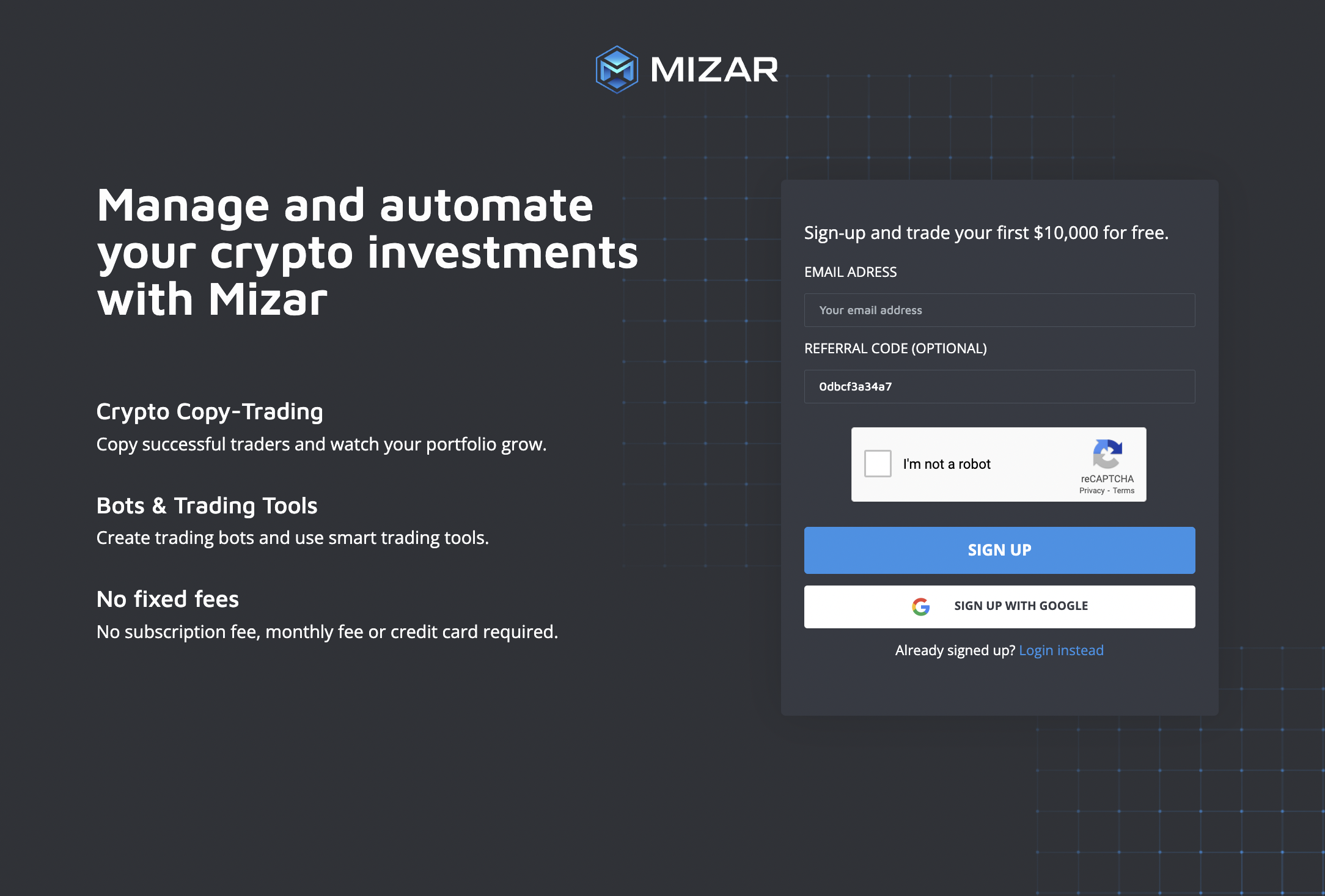

2. Click on [Start trading for free] to proceed. Then sign up to proceed.

3. You can create your Mizar account from scratch or use a Google account as the basis. Once you enter, click on the [DCA-Bots] tab located at the top middle screen. Proceed with [Visit Marketplace] to pick up your ready-to-use DCA bot.

4. Select a strategy you like and click on invest to keep going.

5. Select your crypto exchange and set up API keys. If you’re not sure how to connect API, check the links as you go — each exchange pick gives you a link to a detailed guide. More of a visual person? Watch a quick tutorial on How To Connect Exchange API To the Mizar SmartTrade Platform to make it happen.

Alternatively, you can go for a public API connection and pair your Mizar account with TradingView for a smoother trading experience. Learn more about the TradingView x Mizar benefits you can get.

You can also try out some DCA bots using Mizar paper trading. This way, you can check Mizar Bot performance with your own eyes before putting money into them. Here’s why Mizar paper trading is a big thing.

Advantages of Mizar DCA Bots

Here’s a quick summary of the benefits you can get by using the bots on Mizar’s automated trading platform.

Advanced autopilot. Automated investment and management with no emotions. No monitors, no charts, no emotions. Bots trade on your behalf 24/7. You can still keep tabs and influence your trading performance if required., though.

Live Paper Trading. You can safely test settings for your custom DCA bots in live mode. Experiment with the risk/reward ratio to get the best results before trading real money.

Best entry/exit price.Best entry price. Mizar DCA bots get you the best lowest average price regardless of the market. They fit bull, bear, and flat markets.

Simple investment. Launch your first DCA bot up and running within a few clicks. No prior background or subscription required.

Order management. Set Take Profit, Stop Loss, Trailing & more to maximize your profits and minimize risks.

In Closing

Crypto DCA bots can not only significantly reduce your emotional pressure but also automate your trading experience. Opting for DCA implies a lower average entry price, streamlined asset accumulation, and profits on any market — be it a bull, bear, or flat market.

FAQ

Why Should I Use DCA Bots?

Investors use DCA bots to automate their asset accumulation, and have as little manual inputs as possible. If you believe an asset will grow over the long run, DCA bots may help you accumulate the asset at a lower average price [compared to manual purchase]

Why Use DCA Bots?

DCA bots maximize your chances to accumulate the asset at a lower average price. This way, you can either take your profits sooner or increase potential profits over time.

What Are The Best DCA Bots?

All DCA bots have the same working principle, but some of them allow easier and smoother user experience. A bright example of an intuitive user interface for DCA bots would be the Mizar trading platform.

What Are the Benefits of DCA Bots?

DCA bots serve several purposes: lower average entry price, remove personal emotions and reduce market-related risks. Sticking with DCA bots will get you an investment set in smaller and gradual amounts instead of large sums right away.