Mizar X Sticker Trading Club | How To Use Scalping To Trade Crypto

In this article, we'll explore the basics of scalping in crypto trading, including its advantages and risks. Furthermore, we'll introduce you to Sticker Trading Club, Mizar's newest strategy provider, who uses scalping to optimize his Dollar-Cost Averaging (DCA) bots. We'll delve into how his strategy works and how it could potentially benefit your crypto trading endeavors. So, let's get started and explore the exciting world of crypto trading with scalping.

What is scalping?

Scalping is a trading strategy that involves buying and selling assets quickly and frequently for small profits. In the world of crypto trading, scalping involves taking advantage of the market's volatility by buying and selling cryptocurrencies within a short period, usually a few minutes or hours, to generate profits. Scalpers aim to capitalize on small price movements, often executing multiple trades in a day, which can result in significant profits. However, the high frequency of trades also comes with high transaction costs and risks, making scalping a strategy that requires precision and experience to execute effectively.

Advantages of using scalping to trade Crypto

Potential for high returns: Scalping allows traders to generate small profits multiple times a day, which can add up to significant returns over time.

Taking advantage of volatility: Cryptocurrencies are known for their high volatility, which creates opportunities for scalpers to buy low and sell high in a short time frame.

Reduced exposure to market risks: Since scalping involves holding positions for a short time, traders can minimize their exposure to sudden market shifts that could negatively affect their trades.

Opportunity for consistent gains: Scalping provides traders with a chance to make consistent gains

even in a sideways or bear market, unlike other trading strategies that may require prolonged upward trends to be profitable.

More opportunities to trade: Scalping allows traders to execute multiple trades in a day, increasing the number of opportunities to make a profit.

Introducing Mizar’s Newest Strategy Provider – Sticker Trading Club

We are excited to introduce Mizar's newest strategy provider, Sticker Trading Club. Hailing from Austria, Sticker Trading Club is a seasoned trader who has always been fascinated by new technologies and trading. With a focus on scalping, Sticker Trading Club uses his experience and expertise to optimize Dollar-Cost Averaging (DCA) bots.

Insight into Sticker Trading Club strategies

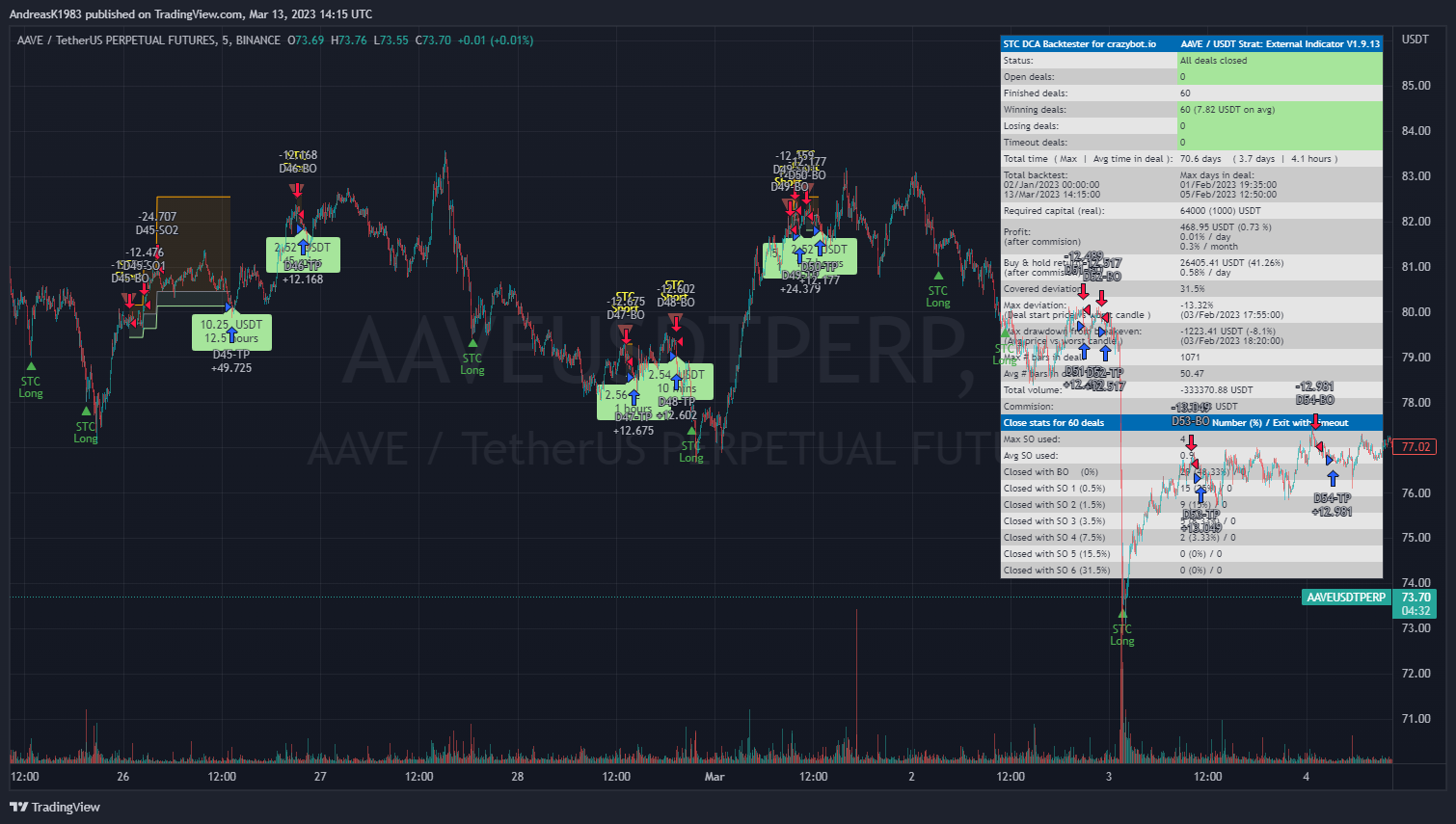

Sticker Trading Club's approach to scalping with DCA bots is based on a combination of technical indicators optimized for each market situation. By using a low take profit and executing fast, short trades on multiple pairs on lower time frames, Sticker Trading Club aims to capitalize on daily price ranges to generate consistent profits.

What sets Sticker Trading Club apart is his ability to adapt to different market situations. With different strategies tailored for uptrends, downtrends, and sideways markets, Sticker Trading Club ensures that his trades are always optimized for the current market conditions. This flexibility and versatility allow for consistent gains even in volatile market conditions, making their approach a reliable choice for crypto traders looking to maximize their profits.

What is the technique behind Sticker Trading Club’s strategy

The technique behind Sticker Trading Club's strategy is based on a combination of several technical indicators, which have been optimized and combined to achieve near-perfect entry points. By using a technical analysis approach to identify key price levels, trends, and momentum, Sticker Trading Club aims to execute trades with precision and accuracy. The technical indicators used in their strategy are carefully selected and tested to ensure that they work effectively in the current market conditions. This approach allows Sticker Trading Club to capitalize on price movements with a high degree of accuracy, leading to consistent gains over time and nearly perfect entries.

Tools used by Sticker Trading Club to execute his strategies

Sticker Trading Club primarily uses TradingView as their primary tool. TradingView provides an extensive range of technical indicators that allow traders to analyze price movements and identify trends, making it a valuable resource for traders. To create a good strategy, Sticker Trading Club has optimized and combined several technical indicators available on TradingView. While many of these indicators are free to use, they often lack accuracy in their base form. Therefore, Sticker Trading Club has found a way to optimize and combine these indicators to achieve greater accuracy and effectiveness in executing trades. This approach allows Sticker Trading Club to make informed trading decisions based on real-time data, leading to more profitable trades.

Are Sticker Trading Club’s strategies suitable for you?

Whether Sticker Trading Club's strategies are suitable for an individual ultimately depends on their level of experience and risk tolerance. However, Sticker Trading Club's strategies are designed to be suitable for anyone who knows how to set up a DCA bot properly and has a solid understanding of risk management.

Overall, if you are a crypto trader with experience in setting up DCA bots and a solid understanding of risk management, Sticker Trading Club's scalping with DCA bots strategies may be a valuable addition to your trading toolkit.

What Should You Take Into Consideration Before Copying Sticker Trading Club’s Bots?

Sticker Trading Club's recommends to not invest more than 0.5% of your wallet size in each position is based on a conservative approach to risk management. This approach is designed to minimize losses and protect your overall portfolio in the event of market volatility or unexpected events that can impact trading outcomes.

Conclusion

To conclude, scalping is a popular trading strategy in the crypto market, and Sticker Trading Club uses it by combining technical indicators and optimizing for various market conditions. Sticker Trading Club holds a strong belief that Mizar has the potential to become one of the top Crypto Bot platforms in the industry, with our subscription free fee-payment system being a particularly appealing feature.

To learn more about Sticker Trading Club and his strategies, subscribe to his YouTube channel and Join his Telegram and Discord community. You can also sign up with Mizar using his referral link.