Protect Yourself from Crypto Scams: A Comprehensive Anti-Scam Guide

The world of cryptocurrencies presents abundant opportunities, particularly among new tokens with small market capitalization (below $1M). While it may be tempting to chase after those massive gains, it's crucial to remember that many people have lost everything. Investing in small projects brings risks, including the possibility of falling victim to cryptocurrency scams, even if everything appears legitimate.

In this article, we will provide guidelines to assist early altcoin investors in protecting themselves against cryptocurrency scams and enhancing safety during trading.

By following this guideline, you can make more informed decisions and learn how to identify fake cryptocurrencies.

Identifying Smart Contract Scams

Tokens essentially consist of smart contracts (ERC-20, BEP-20, and more) encoded in the blockchain. These smart contracts define the token's core logic, such as taxes, minting capabilities, anti-bot measures, and more.

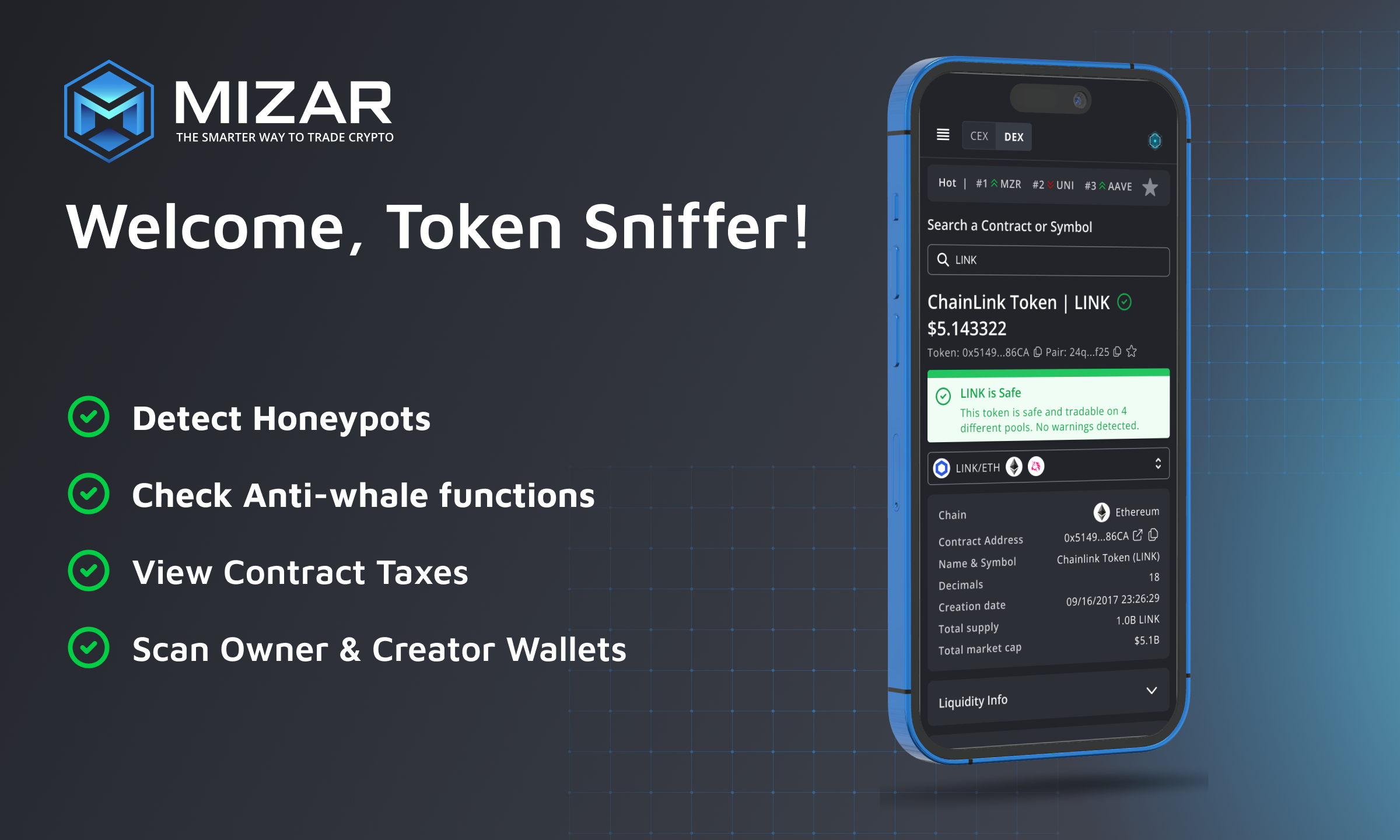

You can scan tokens using the Mizar Token Sniffer, a free and publicly accessible crypto scam checker designed to detect crypto frauds embedded in a token's smart contract before making a purchase. The Mizar Token Sniffer provides critical information about the contract, including:

Buy and sell taxes: excessively high taxes are suspicious.

Maximum buy and sell limits: Too small sell limits are suspicious.

Contract creator and owner: renounced tokens are safer.

Moreover, the Mizar Token Sniffer verifies if a contract is a honeypot. What is a honeypot trap?

Honeypot means a scheme where investors can buy but cannot sell. Mizar Token Sniffer simulates to buy and sell a token and tags it as a honeypot if any issues preventing the sale is detected, such as excessively low maximum sell limits or lengthy cooldown periods. This feature is also used in the Mizar Sniper Bot to protect from purchasing honeypots.

Mitigating Crypto Rug-pulls and Ensuring Liquidity

Even if a token's smart contract is secure, the project behind it can still execute a crypto rugpull, a common method employed to drain investors' funds. Cryptocurrency rug-pulls can take various forms, such as a massive sell-off by the project or the removal of liquidity from all liquidity pools. In either scenario, your investment becomes worthless.

Although it is difficult to perform cryptocurrency rug-pull checks, you can still verify that the project has locked or vested its tokens with smart contracts, and make sure that it matches with the token metrics reported. Locking tokens in a smart contract is to only way to prevent the project from selling all the tokens at once.

Additionally, examine how the developer handles LP (Liquidity Pool) tokens. When developers add liquidity to a pool, they receive LP tokens representing their share of the deposited liquidity. If these LP tokens are locked in a smart contract, the liquidity is considered safe as it cannot be removed until the locking period is over. In case the LP tokens are burned (sent to a burn wallet), then the liquidity cannot be removed anymore.

Mizar is developing an anti-rug system to safeguard investors from crypto rug-pulls. Our crypto rug-pull scanner constantly monitors transactions in the mempool, the staging area for pending transactions before they are validated and executed in the blockchain. By scrutinizing the mem-pool, Mizar can detect cryptocurrency rug pulls before they occur and automatically sell all your tokens before the scammer.

Evaluating the Project's Product

Conducting due diligence on a project's product is essential for identifying scams. Even if a project lacks a functioning product, you can assess its legitimacy by reviewing documentation, white papers, and landing pages. Scams typically exhibit signs of minimal effort, such as spelling errors, inconsistent information, low-quality images, and more.

Assessing Socials

The social aspect plays a crucial role in scam detection. A lack of activity on social channels like Twitter, Telegram, YouTube, Discord, and others is often indicative of a possible scam.

However, it is still possible to fake social traction through the use of bots to simulate likes, views, and comments. Although more challenging, it is still feasible to identify such fake traction. Remember, if things seem too hyped to be true, exercise caution.

Consider Notable Platforms, Launchpads, and Exchanges

Listing on reputable platforms like Coingecko (CGC) and CoinMarketCap (CMC), securing a spot on launchpads such as RedKite or Trustpad, or being listed by exchanges like Bybit, OKX, and KuCoin can indicate a project's credibility. These platforms typically conduct due diligence and maintain close ties with project teams, providing an additional layer of safety and bolstering the project's reputation.

Benefiting from Token Audits

Token audits can enhance a project's reputation. When a reputable firm like Certik audits a token contract, you can have confidence that, at the very least, there are no scams within the smart contract.

Consideration of a Doxxed Team

Projects with a doxxed team, where the founders openly share their identities, inspire more trust. While this makes it more difficult for the project to scam investors, it is not a guarantee against such behavior.

Trust Your Judgment

Finally, trust your instincts and use common sense. If something feels off or raises suspicions, pay attention to your intuition. Scams are often designed to instill FOMO (fear of missing out) and leads you to invest despite your doubts. In such cases, it's best to move on. Remember, no one has ever lost money by non investing.

To summarize, we have provided a comprehensive anti-scam guideline to facilitate your due diligence before purchasing any token. The next time you do your own due diligence about a project, make sure to check all the following boxes:

I verified the contract with Mizar Token Sniffer

I verified the vesting/locking of liquidity and project tokens

I assessed the product and socials

I checked the project's listing on reputable platforms

I reviewed the audit of the token contract

I visited the team members on LinkedIn

I feel confident in purchasing the token

By following these guidelines, you can better protect yourself from scams and make informed investment decisions.