Understanding Token Metrics — How to Read a Crypto Token

Although crypto and blockchain investors spent north of $30 billion last year, retail investors take just a tiny part of the overall profits, mainly because retail allocations are smaller than seed/private investors, but also due to a large share of mediocre projects with questionable investment potential.

This article elaborates on tokenomics — the most and foremost criterion to evaluate the project and take the guesswork out of the equation.

Key Takeaways

Tokenomics is a set of token-related metrics to evaluate the potential supply and demand of a project

Investors use token metrics to assess the project’s future

Most important token metrics reflect either supply or demand from various angles, including timeline, distribution, scope and beyond.

You might want to analyze and compare various token metrics before buying into a project.

What are Token Metrics?

Token metrics, or tokenomics, is a combination of "tokens" and "economy”. Tokenomics combines all the elements that make a particular cryptocurrency valuable and interesting to investors. Everything from the token issuance and distribution to things like its utility.

Tokenomics explores the following.

Purpose: What is the purpose of a token? What does it accomplish?

Functionality: What are the token functions to achieve its purpose?

Disposition: How actively is the token used?

Distribution: How is the token distributed?

Why Token Metrics Matter?

Tokenomics is the key to the fundamental analysis of cryptocurrencies — it’s a knowledge system that helps to decompose the chaotic movement of crypto into a clear chain of causes and effects.

Tokenomics answers the following questions:

How do tokens behave in their interactions with exchanges and individuals?

How many tokens could there be in the world in 5-10 years?

How is the issuance of cryptocurrency regulated?

Why is the token needed, and what is its value?

How stable and reliable is the network?

How many more tokens can be issued and sold?

Therefore, tokenomics is very useful for those willing to invest, trade, create, and beyond. Token metrics are important to each of the parties involved in the circulation of crypto:

To crypto project teams, it helps to develop the rules and maximize their chances to successfully launch & grow.

To expert economists, it helps to identify the patterns of the crypto market.

To token buyers, it helps better understand whether the project is worth their attention.

Key Token Metrics & Terms

Token metrics can vary across projects, but some of them are essential regardless of the project.

Token Utility

The utility is the functional value of a token for a project, what problems it solves and what it's needed for in general. Depending on the utility, tokens can be divided into several types:

Governance tokens — issued to DAO participants, allowing them to vote and participate in decision-making on the project's further development.

Functional tokens — needed to access a service or product. For example, when the Launchpad requires holding native tokens to participate in IDO.

Internal tokens — used to buy internal project resources and assets. For example, to trade on the internal NFT marketplace, to evolve characters, and other activities.

The utility can also include staking programs and other use cases. In general, utility is important even if you are not going to participate in the project because it allows you to understand the following:

Will new users need tokens to enter?

Is there an incentive to keep the tokens earned/rewarded?

This directly affects the balance of supply and demand, as well as the price of the token. In addition, the lack of a real utility implies the team needs the token just for fundraising. Such tokens are potentially dangerous because the price may take a little tumble off the cliff right after listing.

Learn more amount utility tokens to invest smarter.

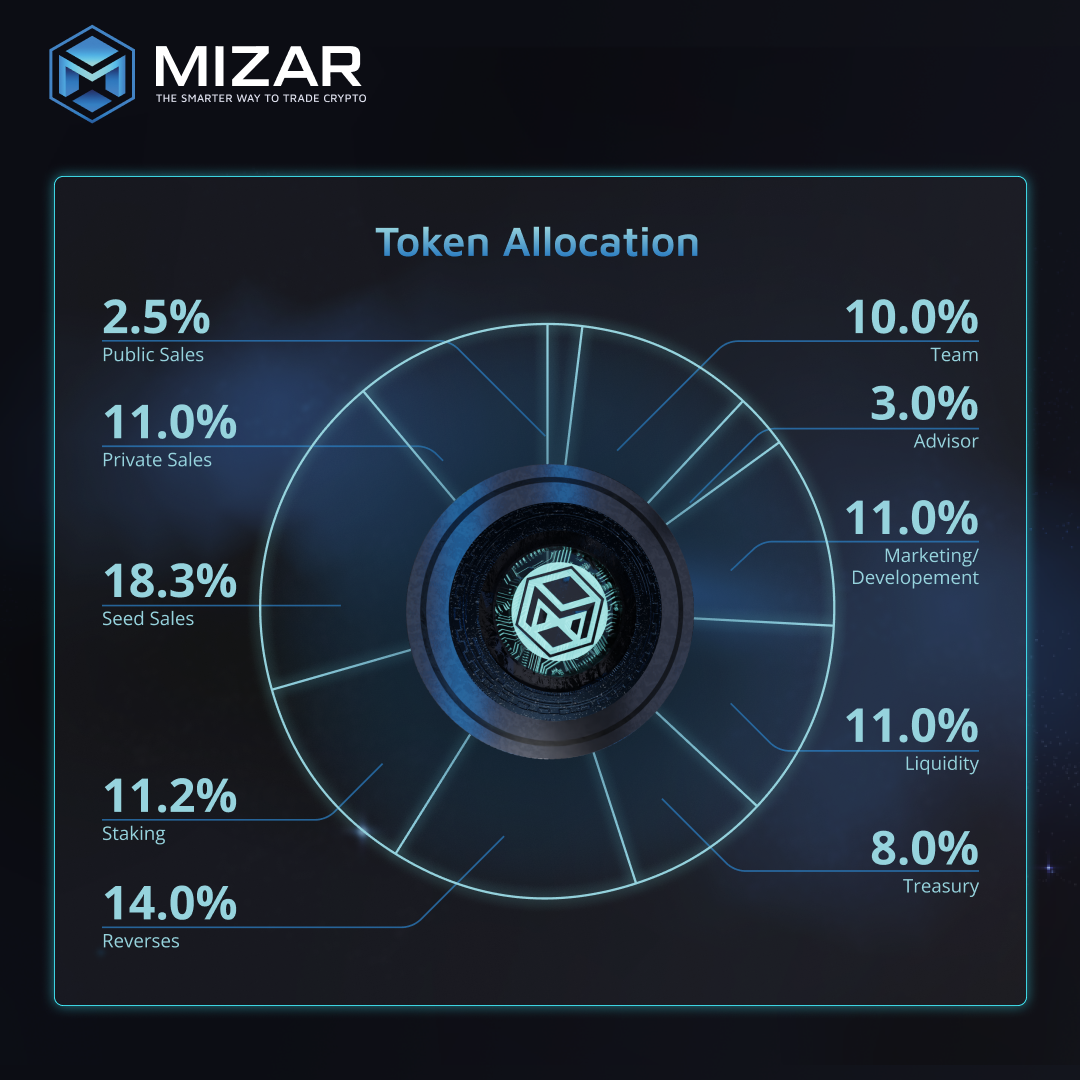

Token Distribution

Token distribution is the most important part of tokenomics, so during research, you should definitely find a distribution chart in the whitepaper or on the website. The chart may look like this, for example:

It may also come in the form of a release schedule like this:

In essence, such charts may show the proportion [who gets what], the timeline [when they get it], and token usage [what the funds raised are used for]. In the distribution chart, you might want to check the following metrics:

Total and start-up offer

Allocation for different types of investors

Price for different rounds

The unlock schedules [vesting, cliff] for all holders after the TGE.

The unlock schedule may look as follows:

A good allocation chart should also answer the following:

How many tokens will there be at all, and how many are available at launch?

How many tokens and at what price do investors get in the various rounds?

When will these investors be able to sell their tokens, and in what amount?

While reading the distribution charts, you may also encounter the following token metrics categories.

Tokenomics: The Treasury

Used to cover the costs of development and support activities. The project’s treasury often serves as an integral part of the ecosystem. For example, Mizar governance participants will have control over three distribution flows of the MZR token, including the Treasury.

Treasury may also be used to keep the economy sustainable. Some projects accumulate funds within the Treasury to stimulate the token’s price in case of emergency [like pump & dump], exploits, etc.

Tokenomics: The Team

Tokens that the team receives as a reward. The longer the team's tokens are unlocked, the longer the developers are interested in developing the project, and the lower the price is dumped.

Tokenomics: The Community

Tokens reserved for rewards, drops, bounties, giveaways, and anything else related to attracting and strengthening the community. These tokens are usually drained right away, so it's important to keep track of the unlock schedule and community share.

Tokenomics: Strategic/Seed/Private Rounds

Tokens for investors. Usually, the best prices and allocations for strategic partners. Some projects focus on so-called fair distribution and allow an even allocation across rounds. Although the idea may seem appealing, such a model brings more risks over the long run as the economy turns less sustainable.

Tokenomics: Public Sale

These are the very IDO you can get into through launchpads or whitelists. Late-stage investors have the smallest allocations and the highest purchase price [compared to private, strategic, and seed rounds]. The price per token is still much lower compared to the price a broader community gets during/after listing.

Mizar Token Metrics

The Mizar team did a deep dive into all the chains that have thrived since to determine what was the best move forward, and after much deliberation, we’ve decided to launch the MZR token on the Ethereum chain. Mizar copy trading & automation platform is launching a native token to backbone the project's economy, fuel the ecosystem, and drive more active users in the long run.

Unlike other trading platforms, Mizar issues a powerful utility token to add more value so that traders can benefit from the trading features and blockchain innovations.

Check out in-depth docs for more information.

Closing Thoughts

Tokenomics is the essential part — a foundation of the project. If you feel like investing in the project [especially as an early investor], you might want to scrutinize the details, talk to other community members, run some calculations, and more to understand whether the project is a good fit for your investment portfolio.

FAQ

What Are Tokenomics In Crypto?

Tokenomics is a combination of tokens + economy. A set of token metrics to show how sustainable the project can be in the future and whether it is worth an investor’s attention

Can Tokenomics Be Changed?

Even though some tokenomics details can be adjusted, the most important ones can’t be changed. Once smart contracts have been launched, no one can alter the token-related data.

How Tokenomics Works?

Tokenomics comprises several token metrics that show total supply [tokens available, unlocking new tokens, token distribution, etc.] and potential demand [how and why it may be formed, for how long, etc.].

How to Read Tokenomics?

To read tokenomics properly, you need to understand each token metric separately. Once you understand what a token metric means, you’ll also understand its effect on the project’s economy.

What Is Tokenomics in Crypto?

Tokenomics, or token metrics, reflect the token’s supply and demand. Taking investors, team members, and users into account, tokenomics shows what you can expect from the project’s economy in the foreseeable future.