What Is A DCA Bot?

Trading bots and associated algorithms are no longer behind the scenes as they were a decade or two ago. Modern bots imply utterly new feature sets and embedded logic. Some trading bots even leverage artificial intelligence to adapt to market conditions in real-time. This article sheds light on what DCA bots are, how they work, and most importantly, how you can benefit from them!

Key Takeaways

DCA bots invest your money at set time intervals.

Investors use DCA bots to accumulate assets at a better average price.

Good DCA bots can make profits regardless of the market, whether bullish, bearish, or sideways.

Both newbie and experienced traders can benefit from automated DCA bots.

You can either build DCA bots from scratch or use ready-to-go crypto bots in under 5 minutes with Mizar.

What Is a DCA Trading Bot?

A Dollar Cost Averaging [DCA] strategy is the practice of investing in an asset or currency at set intervals to reduce the average entry price of a position over time. The task of DCA bots is not just to buy assets at the best price but to profit from trading in automatic or semi-automatic mode. This way, you maximize your chances for profits in the mid to long run. Do you want to learn the basics of bot trading ? Keep tabs on What is a trading bot.

How Do DCA Trading Bots Work?

DCA Bots gradually invest in an asset at n-intervals to reduce the average entry price. Assets are purchased at different prices at different times. Let’s consider a quick example.

DCA Asset Purchase

Let’s assume you have $10,000 and you want to buy BTC. Say your DCA bot invests with a monthly cadence regardless of the price for the next 5 months. This imaginary bot has made 5 BTC/USDT buys in total:

Month | Bought at Price | Amount |

Month 1 | $19,000 | $2,000 |

Month 2 | $18,000 | $2,000 |

Month 3 | $16,000 | $2,000 |

Month 4 | $15,000 | $2,000 |

Month 5 | $18,000 | $2,000 |

Resulting in at total investment of $10,000 at an average price of $17,200. In this scenario, at the end of the last month, you would have made +4.6% of profit, or $465.

No DCA Asset Purchase

Now let’s assume you buy in one go.

Say you see a $20,000 price and consider BTC overvalued. It drops to $19,000, you go all in, and the token further drops to $15,000. You’re now down to -21% loss and, suddenly, stop loss might become an option. Fortunately, the price goes back to $18,000 and you close your position at -5% with a loss of -$526.

The bad news, going all-in too early would deplete your fund reserve, as you only have one attempt to guess. On the other hand, DCA bots invest smoothly, and you can always stop them if you think that’s a smart move. This way, you’re less likely to be stuck helpless with no funds to “buy the dip.”

DCA bots mitigate multiple trading risks and do it automatically. On Mizar, you can access two types of DCA.

1. Custom DCA bots. An advanced DCA experience to implement specific ideas and put them into action according to your trading vision.

2. Copy-trade DCA Bots. A one-click DCA experience created by experienced traders for newbies to copy.

Why Use DCA Trading Bots?

Trading is a game of emotions. Psychological behavior has historically separated the great from the good from the outliers. Where one trader thrived, another might fail due to poor emotional control. Volatility is a nerve-wracking challenge, after all.

DCA bots eliminate the hard work of timing the market and completely remove emotions. Regardless of market conditions, investments at regular intervals do not cause as much stress as trying to guess the best entry point. Dollar-cost averaging strategies are safe and sound for beginners and expert traders.

Moreover, crypto bot trading strategies are great for passive investors and those willing to accumulate assets. DCA requires minimal involvement and time commitment as opposed to active trading. An investor doesn't have to monitor the market or perform fundamental or technical analysis.

What Makes a Good DCA Crypto Trading Bot?

Automated bots and algorithms manage as much as 80% of the crypto market. The question is no longer whether the algorithms work but how well they work. How do you pick a decent DCA trading bot?

Although bots were initially designed for professionals, the technological advancements we have nowadays unlock automated trading for anyone.

Not all bots are made equal, though. Many automated trading platforms discard complicated interfaces and put intuitive experiences at a premium. Some focus on cybersecurity and minimizing risks for end users. Others cultivate the idea of efficient trading powered by solid performance records. The combination of these factors is what makes a powerful DCA bot.

How to Get Started with DCA Trading Bots?

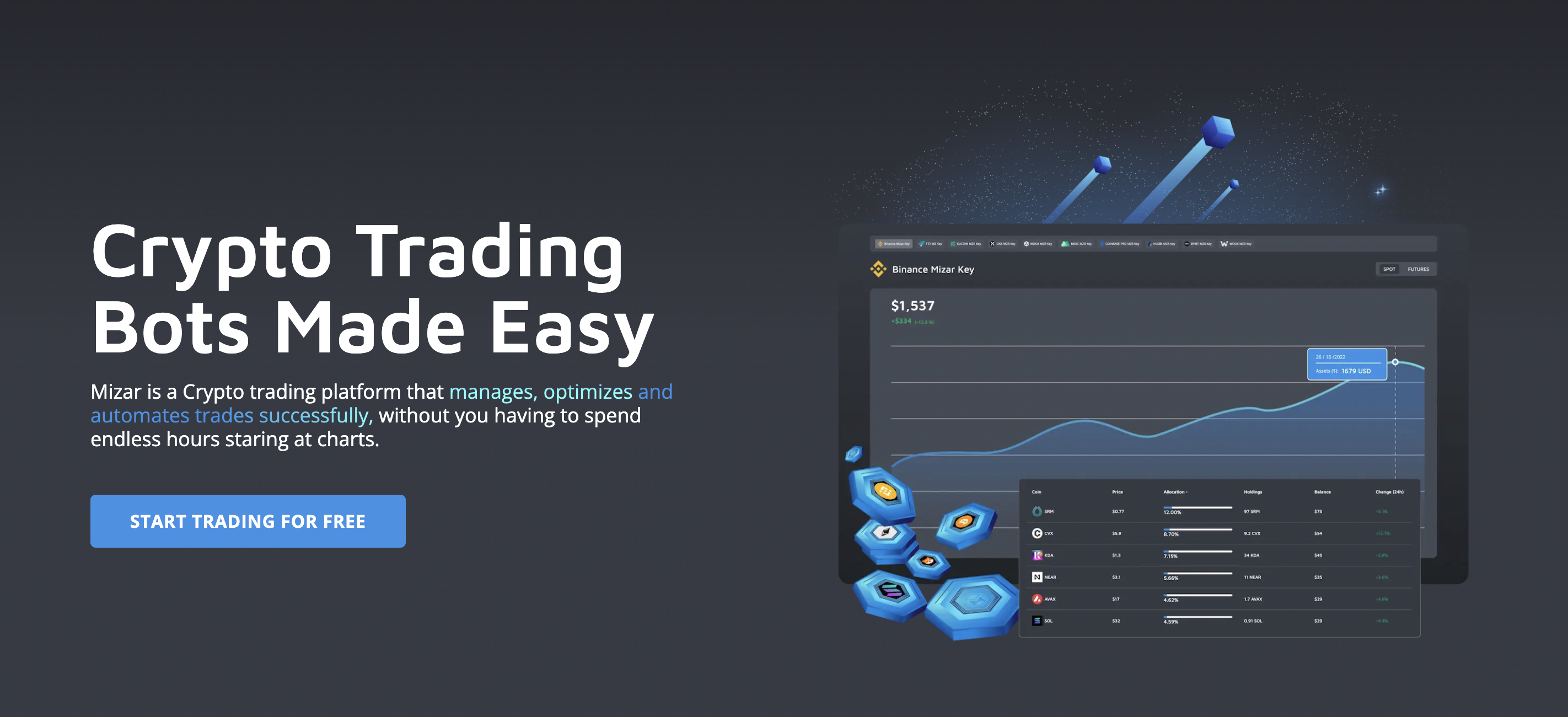

We use the Mizar trading platform as an exemplary case study for easy onboarding. This way, you can start with DCA bots in just a few clicks at no extra cost.

You have two options to use DCA Bots on Mizar.

1. Pick and copy trade with DCA bots from within the Mizar Marketplace

2. Create your own DCA bots to customize your trading experience

Copy trading DCA is the easiest way to get started and learn along the way.

To get started with automated DCA bots, head on to Mizar and sign-up.

Once done, log in to Mizar.

The first thing you can do is connect to a cryptocurrency exchange. Mizar supports the most popular exchanges such as Binance or KuCoin. Watch a quick tutorial on How To Connect Exchange API To the Mizar SmartTrade Platform.

If you don’t feel comfortable with connecting to your exchange, no worries, we got your back covered! You can use Mizar Paper Trading to familiarize yourself with the platform or test new strategies.

Head on to the marketplace and invest in a DCA bit with a few clicks. Select a bot you like and click on invest to move to the next steps. Learn more about one of our official traders — AI Alpha. Their AI trading bots are powered by adaptable artificial intelligence algorithms designed to level up your trading experience.

Check out this video to learn how to invest in a bot: https://www.youtube.com/watch?v=5XcHq9-r9P4

Congrats! You have just invested in a DCA bot. You can pause and adjust the bot at any moment, and manage all your open positions from one single terminal.

If you want to create a custom DCA bot, check out a thorough DCA Bot tutorial we’ve prepared right for you! You can set up your DCA bot in a few steps, and even connect to TradingView webhook or other API systems.

Closing Thoughts

Well-adjusted DCA strategies allow you to automate your trading and investment experience while keeping it efficient. DCA bots solve two key issues many investors have: psychological comfort and automation.

DCA bots allow investing at your own pace with no trading background required. You can start with any deposit and still benefit regardless of the market. Such bots can be a viable investment approach if you’re looking for a passive investment.

FAQ

What Are DCA Bots?

DCA cryptocurrency trading bots gradually invest your money to get a lower average price. This way, you can accumulate more assets regardless of the market cycle. In other words, you’re more likely to secure profits on either bull, bear, or sideways markets.

How Can I Benefit From DCA Bots?

DCA bots automate your buying and selling, allowing profits on bear and bull markets alike. Instead of guessing the entry/exit price, you get an optimal average price and secure reliable profits.

Are DCA Bots profitable?

DCA bots can be quite profitable. Your final profits depend on several factors such as initial capital invested, order management, and settings of your DCA bot.

What is The Best DCA Trading Bot?

DCA bots may perform equally successfully, but performance isn’t the only angle to consider. The Mizar trading platform provides one-click DCA bots powered by the blockchain economy. All for free with no subscription whatsoever.