Mizar X Hawkeye Charting | Insight Into Anti-Cyclical Trading

In this article, we'll provide an overview of the concept of anti-cyclical trading and how it can be applied in the cryptocurrency market. We'll introduce you to our newest strategy Hawkeye Charting, Hawkeye utilizes anti-cyclical trading to deliver profitable strategies. By investing against the prevailing market trends, anti-cyclical trading offers investors a chance to gain returns when others are experiencing losses. We'll explore the potential benefits of this approach, and how Hawkeye Charting's innovative strategy can help investors make informed decisions about their investments in the fast-paced and volatile crypto market.

What is anti-cyclical trading?

Anti-cyclical trading is a trading strategy that involves going against the prevailing trend in the market. Traders who use this strategy will sell when prices are high and buy when prices are low. This is in contrast to procyclical trading, where traders follow the trend and buy when prices are rising and sell when prices are falling. Anti-cyclical traders typically look for opportunities to trade within a defined price range, where they can take advantage of price swings and profit from the market's fluctuations. While anti-cyclical trading can be a profitable strategy in certain market conditions, it can also be riskier than procyclical trading since traders are essentially betting against the trend. It's important for traders to do their own research and carefully manage their risk when using an anti-cyclical trading strategy.

Pros of anti-cyclical trading in crypto:

Profit potential: Anti-cyclical trading can be profitable if executed correctly. By buying low and selling high, traders can make a profit when prices move within a defined range.

Diversification: Anti-cyclical trading can help diversify a trader's portfolio. By using different strategies, traders can reduce their overall risk and potentially increase their returns.

Reduced risk: Anti-cyclical trading can reduce risk by providing an alternative strategy to procyclical trading. By going against the trend, traders can potentially avoid losses during market downturns.

Flexibility: Anti-cyclical trading can be applied to a variety of time frames and crypto assets. Traders can use this strategy to trade daily, weekly, or monthly price ranges.

Opportunity for active management: Anti-cyclical trading requires active management and monitoring of price movements. This can provide an opportunity for traders to stay engaged and informed about market conditions, which can lead to better decision-making.

Introducing Mizar’s Newest Strategy Provider – Hawkeye Charting

We are excited to announce the latest addition to our list of top-performing strategy providers - Hawkeye Charting. Developed by two passionate traders from Germany, Markus and Fabian, Hawkeye Charting brings a unique and innovative approach to crypto trading. With years of experience trading forex and stocks, Markus and Fabian have shifted their focus to the rapidly growing world of crypto trading. Using a combination of technical analysis and anti-cyclical trading.

Insight into Hawkeye Charting’s strategies

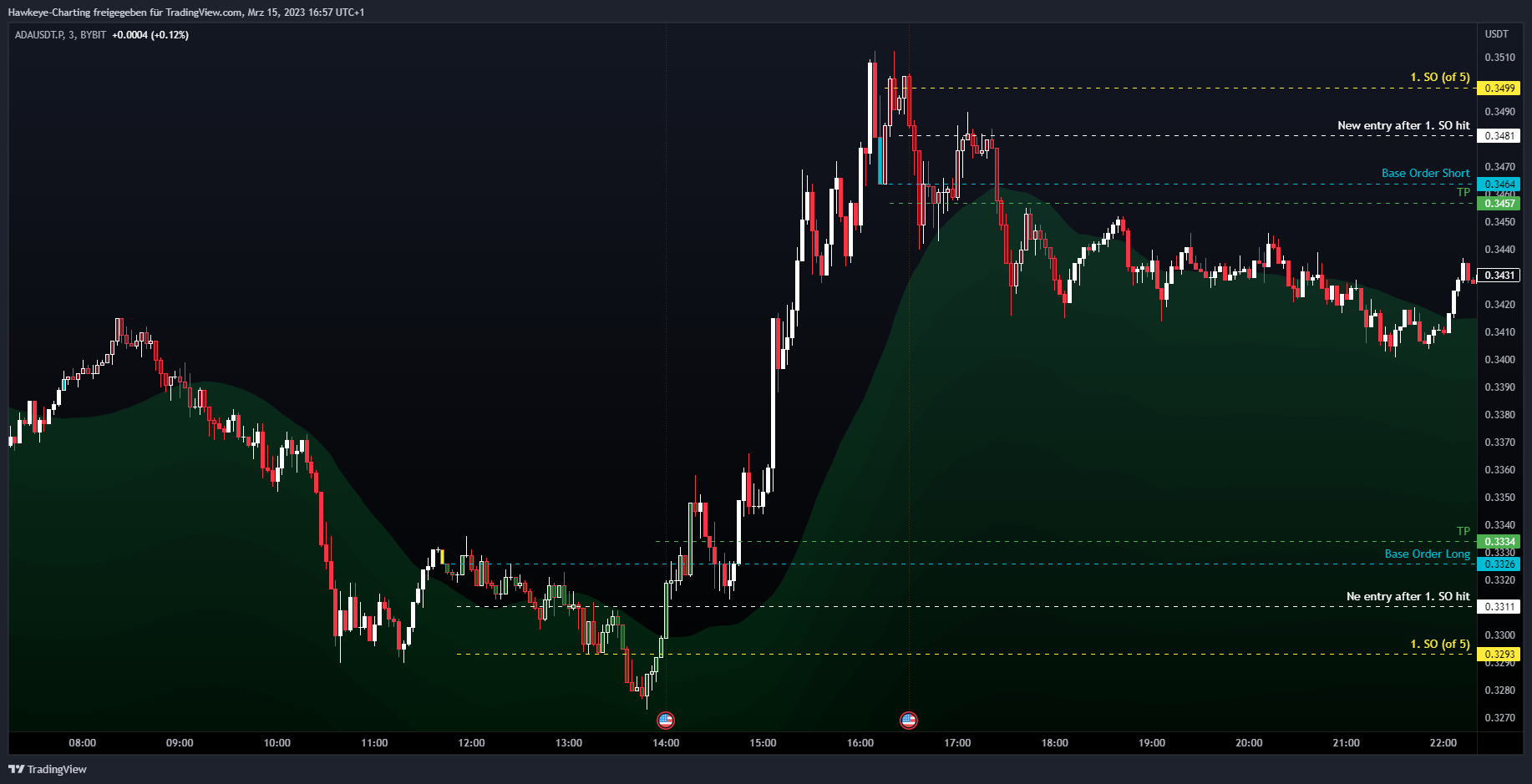

Hawkeye's trading strategy is focused on anti-cyclical trading by copying the trades and movements of market makers using their self-developed script, the Bot Scalping Indicator. They trade range highs for short trades and range lows for long trades without using leverage on their capital. If the price goes through a range, they use DCA to adjust their position.

Their goal is to terminate trades quickly by focusing on the 3m TF and using a TP of 0.75% based on the position volume. While their deals may be small, they add up over time, leading to consistent profits. Overall, Hawkeye's strategy is designed for quick, low-risk trades that can generate consistent returns over time.

What is the technique behind Hawkeye Charting’s strategy

Hawkeyes' trading strategy is based on the principles of market making and counter-cyclic trading using the Bot Scalping Indicator (BSI). By shorting on range highs and longing on range lows, they aim to provide liquidity to the markets and make profits from the price movements. Their use of Dollar Cost Averaging (DCA) helps them to improve their position in case of price fluctuations.

Their approach is supported by solid risk management techniques and a zero capital leverage policy. They claim to achieve a permanent win rate of 100%, which they attribute to their trading style being similar to that of market makers. However, they warn that the use of leverage for fast profits can be risky, and instead, they rely on the leverage of time to achieve their trading goals.

Tools used by Hawkeye Charting to execute their strategies

Hawkeye Charting uses a script on TradingView as one of its primary tools to execute its strategies. This script enables them to receive alerts for suitable entry points and to automatically execute trades using Mizar and the Webhook function. By utilizing this tool, Hawkeye Charting can swiftly and efficiently execute its top strategy.

The script allows for seamless execution of trades, which is essential in the fast-paced world of trading. Furthermore, it allows Hawkeye Charting to stay on top of market movements and make the necessary decisions to optimize their profits. The use of this tool helps create a good strategy by providing a reliable and efficient mechanism to execute trades.

Are Hawkeye Charting strategies suitable for you?

Hawkeye Charting's investment strategies prioritize long-term, consistent growth through compounding returns. Their focus on collection and reinvestment of funds makes them a great option for those seeking a disciplined investment plan. If you value steady growth and are willing to commit to a long-term strategy, Hawkeye Charting could be a great choice for you.

What Should You Take Into Consideration Before Copying Hawkeye Charting Bots?

To set yourself up for success when copying Hawkeye Charting bots, it's important to consider a few key factors. While their scripts can work with any amount of capital, to maximize growth potential, they recommend a starting capital of $500 ($250 for long and $250 for short trades). Additionally, it's crucial to have a clear understanding of your investment goals and risk tolerance before copying any trading bots. By taking these factors into account and staying informed of market risks, you can confidently copy Hawkeye Charting bots and potentially achieve significant returns.

Conclusion

In conclusion, anti-cyclical trading is a strategy that can be used in the crypto market to make profitable trades by investing against the prevailing market trends. Hawkeye Charting utilizes anti-cyclical trading by copying the trades of market makers using their Bot Scalping Indicator. Hawkeye Charting's low-risk trading approach, backed by solid risk management techniques and a zero capital leverage policy, has the potential to generate consistent profits over time.

Hawkeye has had a positive experience using Mizar for order executions, finding the process to be swift and flawless. However, the standout feature for them is the Telegram Bot, which allows them to receive short and quick information without having to constantly visit their exchange.

To learn more about Hawkeye Charting and their strategies, visit their website, subscribe to their YouTube channel and join their Telegram and Discord community. You can also sign up with Mizar using their referral link.